During October, Candriam shifted our views on the UK market. After neutralizing our short GBP stance in our portfolios in early October, we decided during the month to neutralize our underweight on UK equities in the portfolios we manage. Candriam had an underweight stance throughout the entire Brexit episode, since before the June 2016 vote.

Since Boris Johnson took office at the end of July, we believe the chances of a No Deal crash-out at the end of October -- or beyond -- have fallen dramatically. Our analysis suggests the best barometer of this risk is the British pound. We therefore moved quickly to put an end the short GBP exposure as early signs of a common willingness to resolve the deadlock emerged. We view the decline in the Brexit risk premium as a positive catalyst for domestic UK stocks, who should suffer less from a strengthening GBP than the more internationally-exposed large caps listed in London.

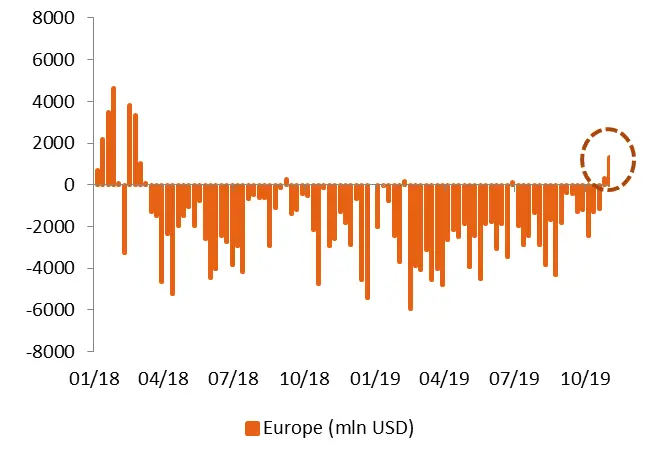

After the shift towards a pro-Euro government in Italy, the (likely) Brexit resolution means that political risk in Europe has fallen. Looking forward, this means that two major potential growth shocks have virtually disappeared, making investments for non-European investors more attractive. In addition, investors appear to be under-allocated to the UK. The recent inflows registers by Pan-European mutual funds are a confirmation of this view.

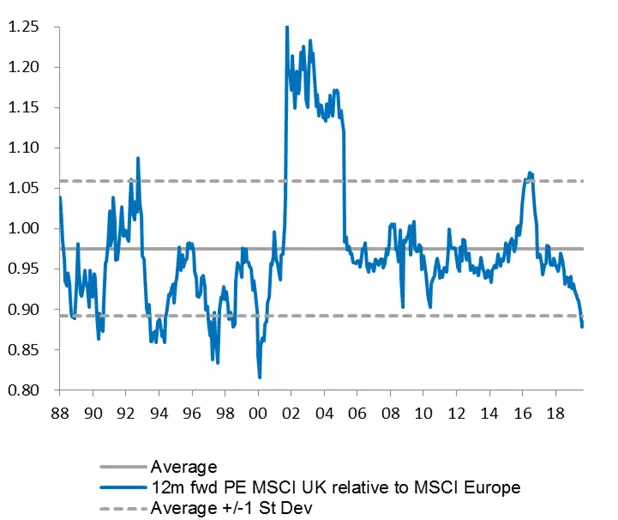

Further, we see attractive relative valuations, which already discount the impact of Brexit. In particular, the negative impact of the no-deal menace during the summer months has pushed relative valuations of the UK market below one standard-deviation of its long-term average vs. the broad European equity universe.

Looking forward, political noise obscures the plausible outcomes, which range from PM Johnson’s deal to no Brexit at all. Some short-term volatility in the GBP and UK assets is likely ahead of the general election on December 12th, but on a medium-term perspective we think that the balance of risks is no longer towards a lower UK currency and assets.

Chart 1

European Equity funds have registered inflows in the past 2 weeks Source : BofAML, Candriam

Source : BofAML, Candriam

Chart 2

The UK equity market valuation has priced in a lot of negative news in the past years Source : Refinitiv, Candriam

Source : Refinitiv, Candriam